-

Hey everyone, staff have documented a list of banned content and subject matter that we feel are not consistent with site values, and don't make sense to host discussion of on Famiboards. This list (and the relevant reasoning per item) is viewable here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Sales Data Updated sales numbers for Switch titles: Princess Peach: Showtime! (1.22M), Mario vs. Donkey Kong (1.12M), and more

- Thread starter mazi

- Start date

- Pronouns

- He/Him

Edit: Actually looking at the last results I think the +510k number for Pikmin 4 in the OP is wrong (5 and 1 switched round) - @mazi this might need a fix

Last edited:

oops, you're right. fixed.Can't say I was expecting Pikmin 4 to outsell TOTK this quarter but that's great for the series. Legs seems pretty good.

Edit: Actually looking at the last results I think the +510k number for Pikmin 4 in the OP is wrong (5 and 1 switched round) - @mazi this might need a fix

Enpsty

Bob-omb

Many replies once again prove the skewed perception of thinking some of these numbers are disappointing due to the insane rate Nintendo games are selling.

For example every company in the world would kill for its game to sell 3.5 mil like Pikmin or 310k for a quarter at $70 almost a year after release like Totk.

Those are insane number people.

SMRPG at 3.5 mil is a huuuge number.

1.1 mil for Mario vs DK is insane.

Don't let the insane numbers of Switch distort your view of what is a success or not.

For example every company in the world would kill for its game to sell 3.5 mil like Pikmin or 310k for a quarter at $70 almost a year after release like Totk.

Those are insane number people.

SMRPG at 3.5 mil is a huuuge number.

1.1 mil for Mario vs DK is insane.

Don't let the insane numbers of Switch distort your view of what is a success or not.

Enpsty

Bob-omb

That's not true. It frequently drops to 40.wow only 90K difference between Breath of the wild and Totk for last quarter. What makes it more amazing, is that theres not been a price drop for BOTW

- Pronouns

- He/Him

Oh!Wait, Pikmin sold half a million in the last quarter? That’s really good.

Oh...Actually looking at the last results I think the +510k number for Pikmin 4 in the OP is wrong (5 and 1 switched round) - @mazi this might need a fix

- Pronouns

- He/Him

I still believe in Pikmin 4 million...Oh!

Oh...

- Pronouns

- He/Him

We don't know how much Pikmin 1+2 sold, right?

Caviar

Tektite

- Pronouns

- He/Him

I'll save everyone the cheek of bumping this horribly aged betting time thread since the OP is banned anyway and instead post an update here:

BotW's 4th quarter: 2.01m (337% increase from previous quarter) - first holiday quarter, big bump was expected

TotK's 4th quarter: 330k (58% decline from previous quarter) - noteworthy that it did not receive any holiday bump in the previous quarter

This actually isn't too noteworthy. People who follow sales threads and trends knew that TotK would open much bigger and drop much faster. That's just the nature of a sequel to a breakout hit on the same hardware. If a new Animal Crossing game released last year instead, it would have compared similarly to New Horizons.

But I think this is noteworthy:

BotW's 29th quarter: 240k (48% decline from previous quarter)

TotK's 4th quarter: 330k (58% decline from previous quarter)

So not only are TotK's legs significantly worse than BotW's launch aligned, but TotK is also barely outselling right now, a game more than 6 years older, and is already declining faster at the end of its 1st year than BotW is at the end of its 7th.

BotW's 4th quarter: 2.01m (337% increase from previous quarter) - first holiday quarter, big bump was expected

TotK's 4th quarter: 330k (58% decline from previous quarter) - noteworthy that it did not receive any holiday bump in the previous quarter

This actually isn't too noteworthy. People who follow sales threads and trends knew that TotK would open much bigger and drop much faster. That's just the nature of a sequel to a breakout hit on the same hardware. If a new Animal Crossing game released last year instead, it would have compared similarly to New Horizons.

But I think this is noteworthy:

BotW's 29th quarter: 240k (48% decline from previous quarter)

TotK's 4th quarter: 330k (58% decline from previous quarter)

So not only are TotK's legs significantly worse than BotW's launch aligned, but TotK is also barely outselling right now, a game more than 6 years older, and is already declining faster at the end of its 1st year than BotW is at the end of its 7th.

Enpsty

Bob-omb

Totk is still $70. Botw often drops to 40$.I'll save everyone the cheek of bumping this horribly aged betting time thread since the OP is banned anyway and instead post an update here:

BotW's 4th quarter: 2.01m (337% increase from previous quarter) - first holiday quarter, big bump was expected

TotK's 4th quarter: 330k (58% decline from previous quarter) - noteworthy that it did not receive any holiday bump in the previous quarter

This actually isn't too noteworthy. People who follow sales threads and trends knew that TotK would open much bigger and drop much faster. That's just the nature of a sequel to a breakout hit on the same hardware. If a new Animal Crossing game released last year instead, it would have compared similarly to New Horizons.

But I think this is noteworthy:

BotW's 29th quarter: 240k (48% decline from previous quarter)

TotK's 4th quarter: 330k (58% decline from previous quarter)

So not only are TotK's legs significantly worse than BotW's launch aligned, but TotK is also barely outselling right now, a game more than 6 years older, and is already declining faster at the end of its 1st year than BotW is at the end of its 7th.

balgajo

Koopa

I'll save everyone the cheek of bumping this horribly aged betting time thread since the OP is banned anyway and instead post an update here:

BotW's 4th quarter: 2.01m (337% increase from previous quarter) - first holiday quarter, big bump was expected

TotK's 4th quarter: 330k (58% decline from previous quarter) - noteworthy that it did not receive any holiday bump in the previous quarter

This actually isn't too noteworthy. People who follow sales threads and trends knew that TotK would open much bigger and drop much faster. That's just the nature of a sequel to a breakout hit on the same hardware. If a new Animal Crossing game released last year instead, it would have compared similarly to New Horizons.

But I think this is noteworthy:

BotW's 29th quarter: 240k (48% decline from previous quarter)

TotK's 4th quarter: 330k (58% decline from previous quarter)

So not only are TotK's legs significantly worse than BotW's launch aligned, but TotK is also barely outselling right now, a game more than 6 years older, and is already declining faster at the end of its 1st year than BotW is at the end of its 7th.

I don’t even believe it will reach my 25M prediction anymore. I’d never expect for BOTW to outpace it either.

I hope the same way they changed direction over Twilight Princess vs Skyward Sword sales they do about BOTW vs TOTK sales. Except for dungeons themes Totk was an iteration of my least favorite BOTW aspects.

You can easily find physical for $50. It’s been like this since November last year.Totk is still $70. Botw often drops to 40$.

Enpsty

Bob-omb

If we go for physical sales then you can find Botw for $20 as well.You can easily find physical for $50. It’s been like this since November last year.

edit: are we going to let another thread to devolve in "I didn't like Totk so let me show you how its sale prove my point".

Kartina

theprocessbroke

- Pronouns

- He/him

Those are rookie numbers, the real objective is now 5mil (pretty unlikely but not impossible). The game has a pretty big chance of reaching 4 mil (especially with the amazing sell through it has)I still believe in Pikmin 4 million...

- Pronouns

- He

I'm glad Greese isn't here to see this.... I don't think he could survive this AND Baldur's Gate 3 winning at the Game AwardsI'll save everyone the cheek of bumping this horribly aged betting time thread since the OP is banned anyway and instead post an update here:

balgajo

Koopa

$70 digital is probably the minority. They still weren’t able to sell all of the 3M difference between sell-through and sell-inIf we go for physical sales then you can find Botw for $20 as well.

Voucher or retailers seems to be the way to go in this moment. So I don’t think $70 is hurting it that much right now. At least not in a way it explain its legs.

Ricimer

Moblin

- Pronouns

- She/Her

I think TOTK's sameyness to BOTW is working heavily to its detriment. Not only do sequels tend to do worse than originals, but why would any new player buy TOTK over BOTW? TOTK doesn't have a unique selling point. It's not like a WW and TP situation where the games are significantly different with different appeals/selling points. You're better off getting the cheaper first game and then maybe check out its 1.5 sequel if you really liked it and aren't burnt out already.I'll save everyone the cheek of bumping this horribly aged betting time thread since the OP is banned anyway and instead post an update here:

BotW's 4th quarter: 2.01m (337% increase from previous quarter) - first holiday quarter, big bump was expected

TotK's 4th quarter: 330k (58% decline from previous quarter) - noteworthy that it did not receive any holiday bump in the previous quarter

This actually isn't too noteworthy. People who follow sales threads and trends knew that TotK would open much bigger and drop much faster. That's just the nature of a sequel to a breakout hit on the same hardware. If a new Animal Crossing game released last year instead, it would have compared similarly to New Horizons.

But I think this is noteworthy:

BotW's 29th quarter: 240k (48% decline from previous quarter)

TotK's 4th quarter: 330k (58% decline from previous quarter)

So not only are TotK's legs significantly worse than BotW's launch aligned, but TotK is also barely outselling right now, a game more than 6 years older, and is already declining faster at the end of its 1st year than BotW is at the end of its 7th.

Enpsty

Bob-omb

Totk is not a 1.5 sequel just because they share the same map.I think TOTK's sameyness to BOTW is working heavily to its detriment. Not only do sequels tend to do worse than originals, but why would any new player buy TOTK over BOTW? TOTK doesn't have a unique selling point. It's not like a WW and TP situation where the games are significantly different with different appeals/selling points. You're better off getting the cheaper first game and then maybe check out its 1.5 sequel if you really liked it and aren't burnt out already.

Ricimer

Moblin

- Pronouns

- She/Her

I don't mean that literally. I'm only saying it's a very similar game to the original. It feels like an expansion turned full game ala Super Mario Galaxy 2.Totk is not a 1.5 sequel just because they share the same map.

It practically is. The Zelda team had so many ideas they couldn't fit them into an expansion, so they went ahead and made a full game.It feels like an expansion turned full game ala Super Mario Galaxy 2

All the same, there is no understating that BotW is a landmark title that people usually buy with the system. Nevertheless, TotK is still massive.

Ricimer

Moblin

- Pronouns

- She/Her

Oh yeah 20m is still amazing sales numbers. There's no question about that. The sameyness in proximity to an evergreen title like BOTW is definitely hurting its legs though. I think they would have been better served longterm making a game more distinct from BOTW.It practically is. The Zelda team had so many ideas they couldn't fit them into an expansion, so they went ahead and made a full game.

All the same, there is no understating that BotW is a landmark title that people usually buy with the system. Nevertheless, TotK is still massive.

Decoyman

Bob-omb

I wouldn't be surprised if this is the last official update we get for Super Mario RPG. I expected a more ambitious result with the hype surrounding it but I guess there's still a ceiling to things. TTYD feels like it's going to fall short of that ceiling by some amount.

Peach did modestly but for a 9 day period in a stacked week that's a bad thing; we know legs worldwide after that period has held really well so I'd expect next fiscal quarter to add at least another 1 digit to the million.

Peach did modestly but for a 9 day period in a stacked week that's a bad thing; we know legs worldwide after that period has held really well so I'd expect next fiscal quarter to add at least another 1 digit to the million.

Koren Lesthe

Turrican, Terranigma and ESO lover

- Pronouns

- He/Him

Sorry if that has been answered already but... why does Metroid Dread never appears in these listings ?

Evil Lucario

Star Successor

It never sells 1 million per fiscal year. It could be selling 700k per fiscal year since 2021 and we wouldn't know because that would go unreported.Sorry if that has been answered already but... why does Metroid Dread never appears in these listings ?

- Pronouns

- He/Him

In terms of total sales, Tears of the Kingdom is still performing like a same-console Zelda sequel, which normally arrive at 40 to 60% of their predecessor's sales total (Triforce Heroes being the lower end of the spectrum, Spirit Tracks being the higher end, and TotK itself landing at the higher end). Obviously, that comparison excludes Twilight Princess from the calculation, given it launched on Wii as well as GC.

edit - I guess we could include Four Swords Adventures from GC, which never broke the million mark (as far as I know) and so sold less than 25% as much as Wind Waker, as the real low point for 'same console Zelda sequels'.

edit - I guess we could include Four Swords Adventures from GC, which never broke the million mark (as far as I know) and so sold less than 25% as much as Wind Waker, as the real low point for 'same console Zelda sequels'.

Koren Lesthe

Turrican, Terranigma and ESO lover

- Pronouns

- He/Him

Thanks !It never sells 1 million per fiscal year. It could be selling 700k per fiscal year since 2021 and we wouldn't know because that would go unreported.

Oh yeah 20m is still amazing sales numbers. There's no question about that. The sameyness in proximity to an evergreen title like BOTW is definitely hurting its legs though. I think they would have been better served longterm making a game more distinct from BOTW.

They will more than likely do that next time with new hardware.

It will still be open world, but it will be more distinct than TOTK was from BOTW, I’m expecting. If they did it this time around, we might not have even gotten a sequel 3D Zelda on Switch. Even with asset and tech reuse the game took extremely long to develop.

- Pronouns

- He/Him

Also kinda crazy looking back at the array of blockbusters Nintendo pushed out in 2022: Pokemon Legends (15m), Kirby & the Forgotten Land (7.5m), Switch Sports (13m), Splatoon 3 (12m), Pokemon Scarlet & Violent (25m). Given last year's software totals included ongoing sales from those strong performers as well as 20.6 million for Zelda and 13.4 million for Mario makes me more convinced some sort of Nintendo Selects range is coming soon, with Nintendo expecting a relatively slow decline for the software market even with the obvious absence of any major selling title for the fiscal year as it stands.

Ricimer

Moblin

- Pronouns

- She/Her

I seriously don't understand how they took 6 years on TOTK. Direct sequels with that level of reuse normally take way less time. TOTK had a longer development than BOTW for Pete's sake! I hope a more original open world Zelda doesn't take 7-9 years gulpThey will more than likely do that next time with new hardware.

It will still be open world, but it will be more distinct than TOTK was from BOTW, I’m expecting. If they did it this time around, we might not have even gotten a sequel 3D Zelda on Switch. Even with asset and tech reuse the game took extremely long to develop.

Enpsty

Bob-omb

They literally spent a whole year to make sure everything in the game works as intended and you're wondering why it took 6 years?I seriously don't understand how they took 6 years on TOTK. Direct sequels with that level of reuse normally take way less time. TOTK had a longer development than BOTW for Pete's sake! I hope a more original open world Zelda doesn't take 7-9 years gulp

Totk is the most ambitious game of all time and every once of its ambitions worked flawlessly. It makes total sense that it took so long.

Enthusiasts definitely overestimate the sales potentials of Mario RPGs. Nevertheless these are decent results.I expected a more ambitious result with the hype surrounding it but I guess there's still a ceiling to things. TTYD feels like it's going to fall short of that ceiling by some amount

The systems in TotK are bonkers. They even took a whole year for QA.I seriously don't understand how they took 6 years on TOTK. Direct sequels with that level of reuse normally take way less time.

- Pronouns

- He/Him

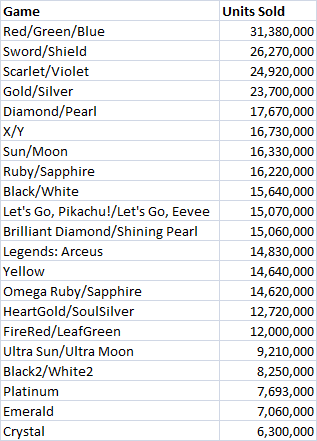

Here's my traditional Pokémon sales chart

Some 3DS games had some updated numbers too!

Shame it doesn't seem like SV will overtake SwSh after all. Still, amazing success for amazing games.

Comic Obsessed

Chain Chomp

PPS and MVsDK sold fairly well.

Hope Another Code didn't completely bomb.

Hope Another Code didn't completely bomb.

Guaraná

Paratroopa

it amazes me that 2 of the top 3 Pokemon sales are on Switch.Also comparison of Pokémon's 6th quarter sales for new generations

SV: 560k

SWSH: 750k

SM: 50k

XY: 150k

SV has slipped a bit behind but SWSH was in the big Switch COVID boom

Shame it doesn't seem like SV will overtake SwSh after all. Still, amazing success for amazing games.

covid boost helped SWSH

Decoyman

Bob-omb

Having the opposite takeaway from this update; SV pulling 560k last quarter makes me think it still stands a good chance at unseating SwSh by the end of the year. In particular it may be used to push hardware bundles in a year where Nintendo's going to have to rely on every trick in the book to meet their 155M milestone forecast.Shame it doesn't seem like SV will overtake SwSh after all. Still, amazing success for amazing games.

- Pronouns

- He/Him

In sales terms, off the top of my head, Switch also has:it amazes me that 2 of the top 3 Pokemon sales are on Switch.

- 3 of the top 5 Zelda titles

- the top 2 3D Mario titles

- the top 2 Mario Party titles

- 2 of the top 3 Kirby titles

- Pronouns

- He/Him

Having the opposite takeaway from this update; SV pulling 560k last quarter makes me think it still stands a good chance at unseating SwSh by the end of the year. In particular it may be used to push hardware bundles in a year where Nintendo's going to have to rely on every trick in the book to meet their 155M milestone forecast.

SwSh is still selling about 20% of what SV is selling, though. Considering it will keep declining, I don't think it will have enough time to overtake it.

Sky Walker

Cappy

More figures of other zelda games:In terms of total sales, Tears of the Kingdom is still performing like a same-console Zelda sequel, which normally arrive at 40 to 60% of their predecessor's sales total (Triforce Heroes being the lower end of the spectrum, Spirit Tracks being the higher end, and TotK itself landing at the higher end). Obviously, that comparison excludes Twilight Princess from the calculation, given it launched on Wii as well as GC.

edit - I guess we could include Four Swords Adventures from GC, which never broke the million mark (as far as I know) and so sold less than 25% as much as Wind Waker, as the real low point for 'same console Zelda sequels'.

Ocarina of Time "N64": 7.6m sold.

Majora's Mask "N64": 3.3m sold.

Ocarina of Time 3D: 6.4m sold

Majora's Mask 3D: 3.4m sold

- Pronouns

- He/Him

Well Iiiiii liked it.Ugh, one million for Mario vs DK annoys me. I thought the game looked bad and played worse.

My favorite Nintendo game so far this year! I do not care how limited that field is!

Kirby.

Damn.

Make it to 10 million now

Damn.

Make it to 10 million now

- Pronouns

- He/Him

1) Like everyone said yesterday, you continue to downplay Covid which clearly impacted everything including most of TotK's development.I seriously don't understand how they took 6 years on TOTK. Direct sequels with that level of reuse normally take way less time. TOTK had a longer development than BOTW for Pete's sake!

2) The new systems were insane and Nintendo spent a year QA testing them instead of releasing the game in 2022.

3) The depths and the sky still took a ton of development time even if they were able to reuse base Hyrule.

fluttersusagi

moonlight is the message of love <3

- Pronouns

- she/they

woah, that's uh...a lot weaker sales for peach then i was expecting.

Tentacle-tropes

Kremling

For 9 days I would say that is pretty good. I’ve said before that getting to 1mil was the goal for the game. Anything after that is extra.woah, that's uh...a lot weaker sales for peach then i was expecting.

Lugia667

Inkling

- Pronouns

- He/Him

....I seriously don't understand how they took 6 years on TOTK. Direct sequels with that level of reuse normally take way less time. TOTK had a longer development than BOTW for Pete's sake! I hope a more original open world Zelda doesn't take 7-9 years gulp

Tunes of the Kingdom: Evolving Physics and Sounds for 'The Legend of Zelda: Tears of the Kingdom'

Developers of The Legend of Zelda: Tears of the Kingdom discuss structuring an expanded Hyrule around physics-based gameplay and evolved sound design! Join the game's Technical Director Takuhiro Dohta, Lead Physics Programmer Takahiro Takayama,...

this is why

- Pronouns

- He/Him

What were you sales expectations in 10 days for the Peach game where 1.22 mill wasn't a good result?woah, that's uh...a lot weaker sales for peach then i was expecting.

JR436

Probably looks better in a dress.

- Pronouns

- He

Relatively pleased with those Peach numbers.

Was always a little confused from people saying it'd be a smash hit. Even disregarding the focus on younger players, Peach as a character doesn't have the built cache that Luigi or Yoshi do. This is her second game, nearly 20 years after the first one.

Was always a little confused from people saying it'd be a smash hit. Even disregarding the focus on younger players, Peach as a character doesn't have the built cache that Luigi or Yoshi do. This is her second game, nearly 20 years after the first one.